accumulated earnings tax c corporation

The tax C corporation distributes a patent to. The accumulated after tax profits can be used to pay off corporate debt or for working capital to operate or grow the business instead of opening a Line of Credit loan.

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

8 Are the corporations total receipts see instructions for the tax year and its total assets at the end of the tax year less than 250000.

. 3611213 Form 100S 2021 Side 1 B 1. However if the S corporation itself was previously a C corporation it may have accumulated EP from years when it was a C corporation. A regular C corporation distributing its earnings out of retained earnings is considered a dividend.

A Corporation or an LLC that elects C Corporation tax status can retain up to 250000 without having to justify and pay a higher tax rate on its accumulated earnings. Expansion construction new equipment new factory acquisition etc. The accumulated earnings tax may be imposed on a corporation for a tax year if it is determined that the corporation has attempted.

For purposes of this section the term applicable earnings has the meaning given to such term by section 956Ab except that the provisions of such section excluding earnings and profits accumulated in taxable years beginning before October 1 1993 shall be disregarded. If the accumulated earnings tax applies interest applies. Prior to amendment text read as follows.

S corporations in general do not make dividend distributions. Another implication of the nimble dividend rule is that it does not carry indirect foreign tax credits Regs. An LLCC-Corp that accumulates more than 250000 or 150000 in a Personal Service Corporation may be able to avoid the Accumulated Earnings Tax if they are able to prove they have a realistic plan for the use of those earnings.

During this taxable year did another person or legal entity acquire control or majority ownership more than a 50 interest of this corporation or any of its subsidiaries that owned California real property ie land buildings leased. Fifty percent or 50000 of the total distribution was from accumulated earnings and profits. If Yes the corporation is not required to complete Schedules L and M-1.

An S corporation will only have accumulated earnings and profits if it was a C corporation at some time or acquired or merged with a C corporation. The S election affects the treatment of the corporation for Federal income tax purposes. A corporation that has an accumulation of earnings may be liable to pay the accumulated earnings tax unless the business can show that the earnings over the threshold are for reasonable needs of.

C corp shareholders receive Form 1099-DIV and they will in turn report the dividend on their individual federal tax return. The corporation has 1 Million Earnings and Profits. However if a corporation allows earnings to accumulate beyond the reasonable needs of the business it may be subject to an accumulated earnings tax of 20.

3 Post-1986 earnings and profits The term post-1986 earnings and profits means the earnings and profits of the foreign corporation computed in accordance with sections 964a and 986 and by only taking into account periods when the foreign corporation was a specified foreign corporation accumulated in taxable years beginning after. A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons. Distribution from S Corporation Earnings.

1902-1b4 when the sum of the foreign corporations current plus accumulated earnings and profits is zero or less. 7 Enter the accumulated earnings and profits of the corporation at the end of the tax year. Under current tax law an S corporation cannot produce earnings and profits EP.

The corporations aggregate average annual gross receipts determined under section 448c for the 3 tax years preceding the current tax year are more than 26 million and the corporation has business interest expense.

Demystifying Irc Section 965 Math The Cpa Journal

Oh How The Tables May Turn C To S Conversion Considerations Stout

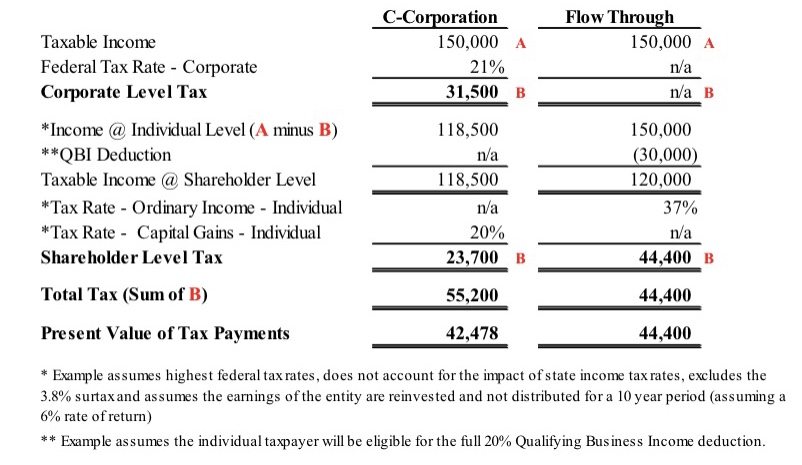

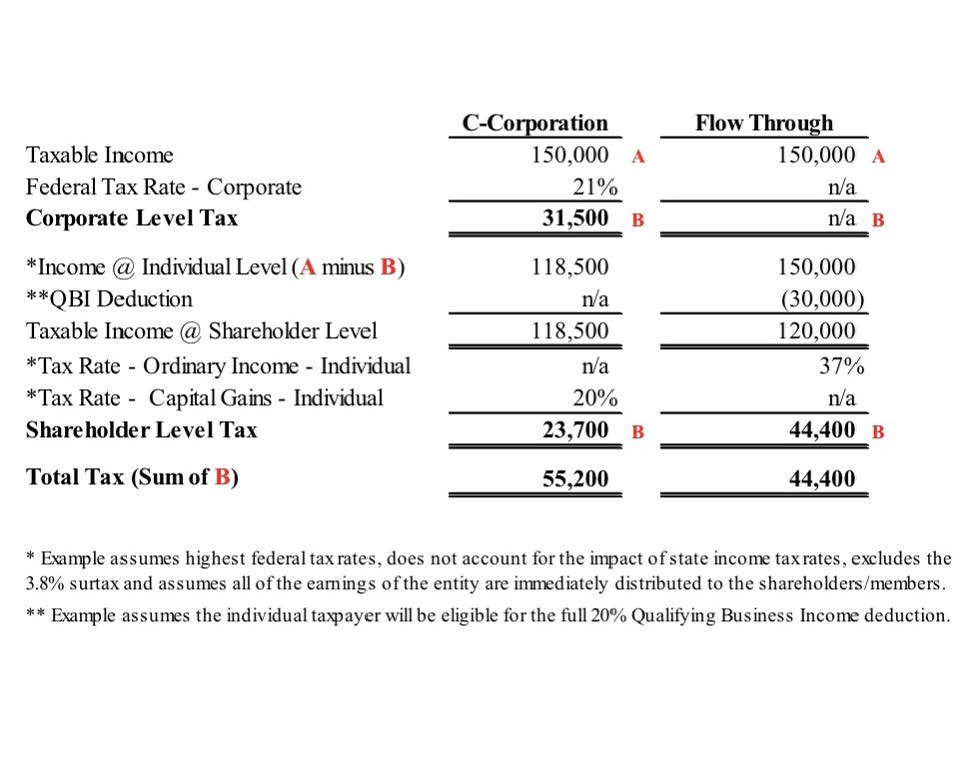

Significant Cuts To The Corporate Tax Rate Is It More Beneficial To Be A C Corporation Now Bernard Robinson Company

Earnings And Profits Computation Case Study

Determining The Taxability Of S Corporation Distributions Part Ii

How To Calculate The Accumulated Earnings Tax For Corporations Universal Cpa Review

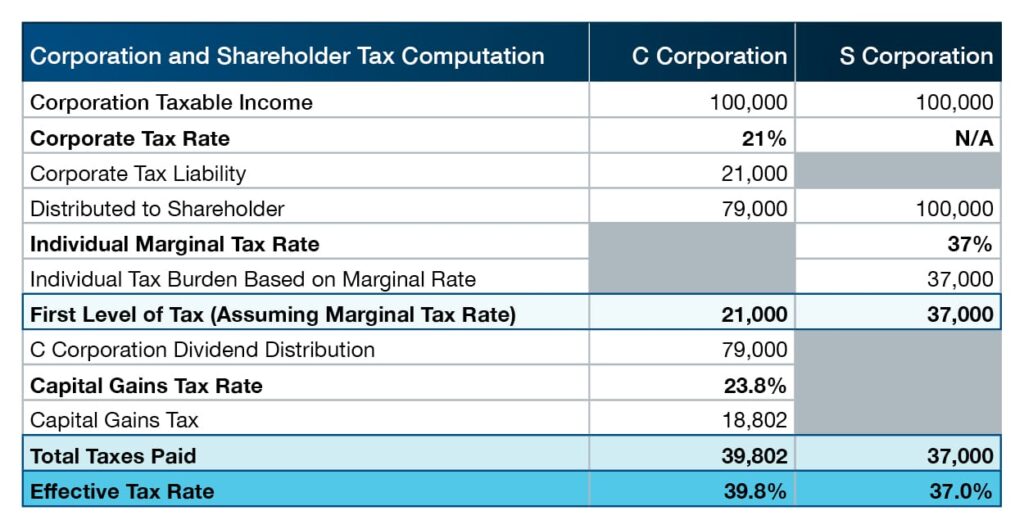

Tax Treatment For C Corporations And S Corporations Under The Tax Cuts And Jobs Act Smith And Howard Cpa

Cares Act Implications On Corporate Earnings And Profits E P

Earnings And Profits Computation Case Study

Earnings And Profits Computation Case Study

Tax Treatment For C Corporations And S Corporations Under The Tax Cuts And Jobs Act Smith And Howard Cpa

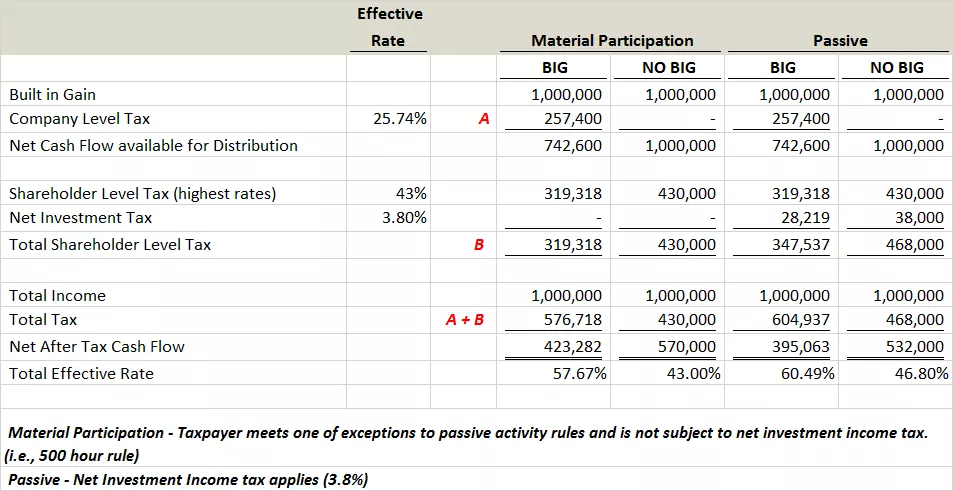

S Corporation Or C Corporation Under The Tax Cuts And Jobs Act Pya

Solved Please Note That This Is Based On Philippine Tax System Please Put Course Hero

Significant Cuts To The Corporate Tax Rate Is It More Beneficial To Be A C Corporation Now Bernard Robinson Company

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Oh How The Tables May Turn C To S Conversion Considerations Stout